At present large number of Government transactions relating to receipts and payments are done through paper based manual systems. This system often results in delays owing to considerable manual efforts in accounting and reconciling these transactions. Government treasuries are now fully computerized and most of the Government offices are provided with broadband facility. Government therefore decided to switch over to electronic mode of financial transactions relating to all Government departments.

A centralized automated environment for faster receipt of revenue and quick fund transfer towards beneficiaries' account will enhance efficient fund management and facilitate easy and perfect record keeping in digital form.

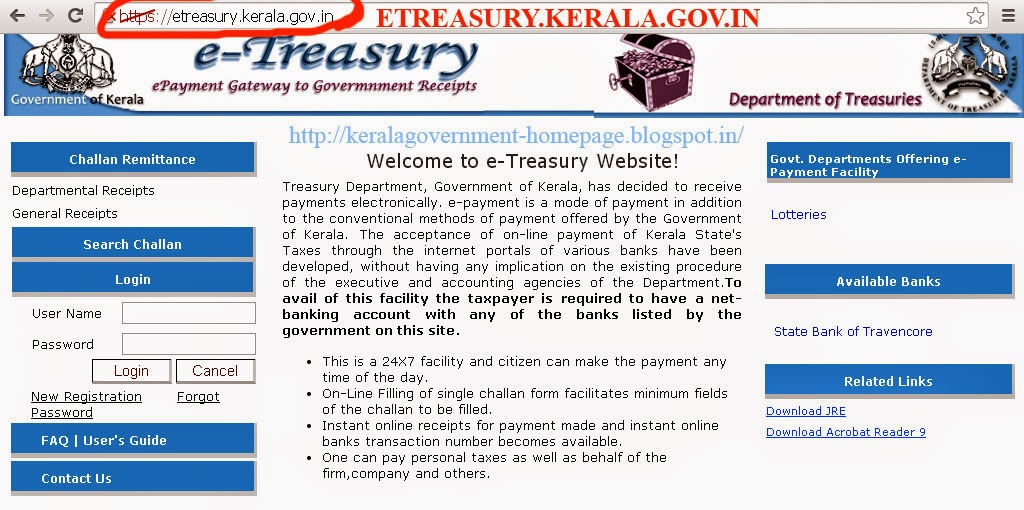

The new system enables the remitters to make online payment using net banking facility of designated banks. The remitters no longer be required tovisit treasury to get their chalans verified by the officer in treasury. All electronic remittances will be carried out through an e-chalan generated from e-treasury. The Agency banks shall designate one nodal branch to carry out all electronic transactions through e-treasury. The interactions between electronic treasury and nodal branch of Agency banks shall be done at fixed intervals through a predefined messaging format.

Remitter can access e-treasury portal and furnish the required details to generate e-chalan with a unique Government Reference Number (GRN). Thereafter payment can be made using net-banking facility of the designated bank. Upon conclusion of payment, another unique reference number viz: Bank Reference Number (BRN) will be generated. The payment confirmation will then be passed to treasury portal which will generate an e-acknowledgment to the remitter with both GRN & BRN. The information to be keyed in for generating e-chalan will be minimised in such a way that basic data of repeated remitters of uniform nature, will be prestored in treasury portal so as to avoid repeated entry every time. All other details may be either pre-fetched or selectable. Upon selecting the purpose and department, the head of account shall be automatically populated in the treasury portal.

The transactions shall be settled on t+ 1 basis and single version electronic scroll shall be used between treasury and bank systems using secured online channels. The nodal branch of Agency bank attached to e-treasury shall generate e-scrolls based on electronic receipts and digitally sign the scroll and share e-scroIl with e-treasury and Reserve Bank of India in the predefined reporting formats. RBI shall provide transaction level data of e-receipts on Government account to e-treasury officer through an automated online interface.

Any error reported in e-scroll shall be resolved through Memorandum of Error process defined separately. The e-treasury officer shall render accounts of all electronic transactions to stakeholder Departments/ Agencies in electronic form.

The existing procedure for accepting Government receipts of Commercial Taxes, Motor Vehicles, State Excise Departments will continue as such till the same is integrated to the e-treasury system. However those departments having no e-payment system at present shall operationalise and integrate their

e-payment system to e-treasury portal immediately.